With sophisticated scams on the rise, it’s crucial to stay vigilant and protect your personal information. Scammers use various tactics to trick you into revealing sensitive details that can be used to access your bank accounts. Here’s what you need to know to help keep your information and accounts safe.

Don’t share personal or sensitive information

Never share personal or sensitive information, such as:

- User IDs and Passwords: Keep your bank login details confidential.

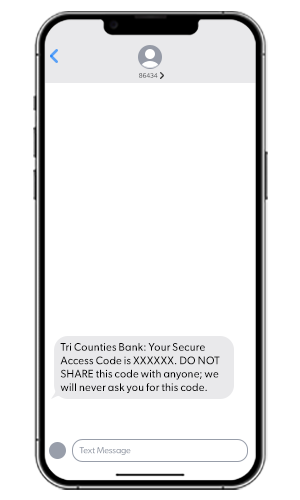

- Secure Access Codes: These six-digit codes add extra protection to Mobile and Online Banking systems. These codes are sent to your phone (via text or call) to provide an additional layer of security, such as when you log in from a new device. Never share these codes with anyone.

Tri Counties Bank will never contact you by phone, text or email and ask for your User ID, password, Secure Access Code, PIN, or other sensitive information. If you receive a suspicious call, always hang up and call us directly at 1-800-922-8742 or visit your local branch.

Beware of these deceptive schemes

- Impersonation scams: Scammers attempt to impersonate Tri Counties Bank and other financial organizations. Fraudsters use technology to manipulate caller ID to trick you into thinking they are legitimate. Hang up and call us at 1-800-922-8742 or contact your local branch to confirm the communication is from Tri Counties Bank.

- Asking you to send money to yourself: Scammers might try to trick you into thinking you have fraud on your account. To reverse it, they suggest you transfer money "to yourself" when, in fact, the money is being sent directly to the scammer. Tri Counties Bank will never ask you to send money to anyone, including yourself, to reverse a fraudulent transaction or establish a new account.

- Special Character Code: Be wary if you’re asked to type a code into your device starting with a special character (like *72 or **21). This activity could enable scammers to redirect your calls and texts and gain access to Mobile and Online Banking services.

Don’t follow any instructions from an unsolicited caller. Hang up immediately. Call us at 1-800-922-8742 to verify suspicious communication.